Understanding What Pet Insurance Really Covers

Navigating pet insurance can feel confusing, but understanding what's covered is the most important first step. Most plans are designed to handle the unexpected—things like accidents and illnesses—but coverage can vary significantly.

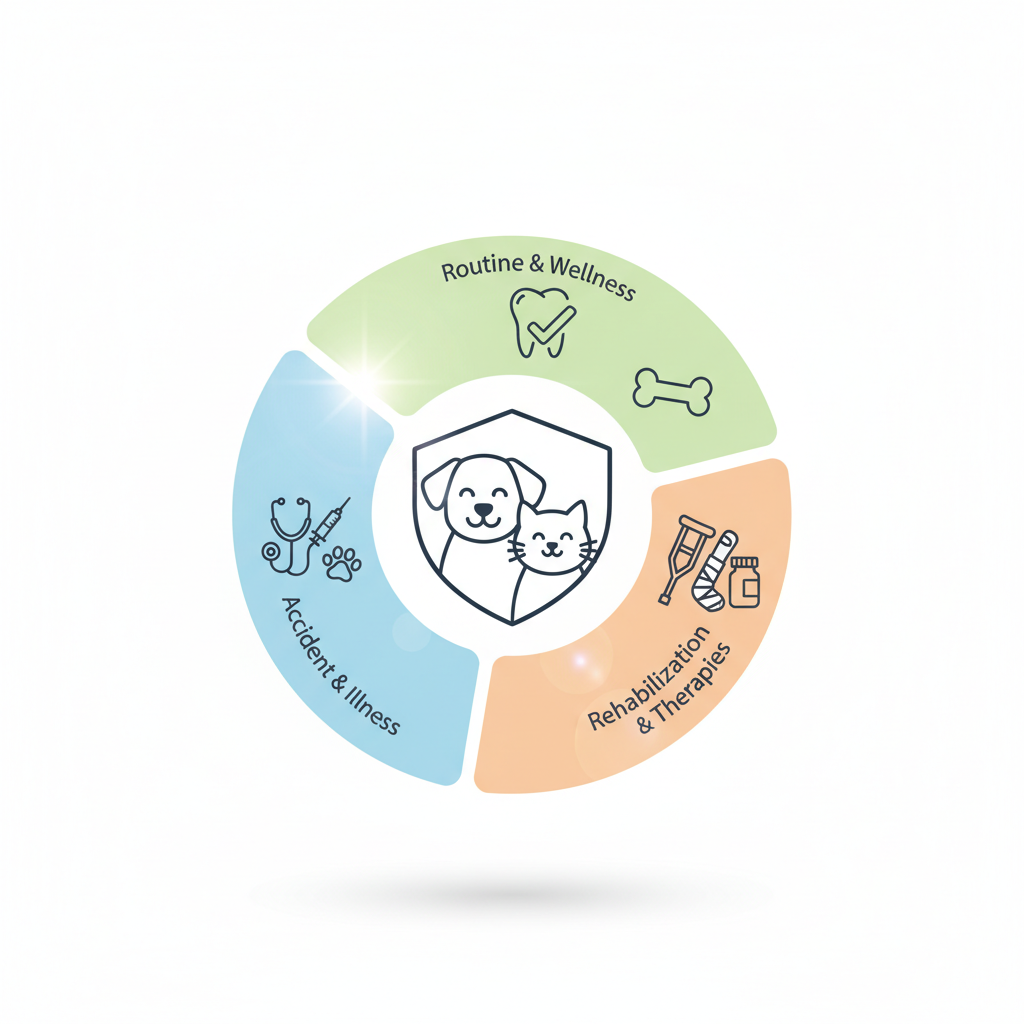

The Three Main Types of Pet Insurance Plans

Understanding what pet insurance covers begins with knowing the different types of plans available. While policy details can vary between providers, most plans fall into one of three main categories. Choosing the right one depends on your budget, your pet's needs, and your desired level of financial protection against veterinary bills.

1. Accident-Only Plans

As the name suggests, accident-only plans are the most basic and typically the most affordable type of pet insurance. These policies are designed to provide a financial safety net for unexpected physical injuries. Coverage is strictly limited to events classified as accidents, which can include a wide range of unfortunate situations. Common examples include broken bones from a fall, torn ligaments from playing too rough, injuries sustained in a car accident, accidental poisoning, or costs associated with your pet swallowing a foreign object that requires surgical removal.

This type of plan is often chosen by pet owners on a tight budget who still want some form of protection against catastrophic events. It can also be a good option for young, generally healthy pets that are less likely to develop chronic illnesses but are prone to getting into trouble. It's crucial to remember that these plans will not provide any reimbursement for illnesses, such as infections, cancer, or hereditary conditions. They are purely for emergencies resulting from an accident.

2. Accident and Illness Plans (Comprehensive Coverage)

Accident and illness plans are by far the most popular and comprehensive type of pet insurance on the market. They offer a much broader scope of coverage, encompassing both the accidental injuries covered by the basic plans and a wide array of illnesses and diseases. This is the type of policy most people think of when they consider getting pet insurance, as it provides protection against the majority of high-cost veterinary treatments that a pet might face throughout its life.

Under an accident and illness plan, you can expect coverage for diagnostics and treatments related to conditions like cancer, arthritis, allergies, diabetes, infections, digestive problems, and more. This includes the costs of exams, bloodwork, X-rays, MRIs, ultrasounds, prescription medications, surgery, and hospitalization. Because they cover such a wide spectrum of health issues, these plans provide the greatest peace of mind, ensuring you can make medical decisions for your pet based on their needs rather than being limited by your finances.

3. Wellness or Preventive Care Plans (Add-Ons)

It's important to note that wellness or preventive care coverage is almost always offered as an add-on to an existing accident and illness plan, not as a standalone policy. While a standard insurance plan is designed to help with unexpected and often expensive costs, a wellness plan helps you budget for predictable, routine veterinary care. It works more like a savings plan, reimbursing you for a set amount for specific preventive services throughout the year.

Coverage under a wellness rider typically includes services that keep your pet healthy and prevent future problems. This can include annual physical exams, routine vaccinations, flea, tick, and heartworm prevention, routine blood screenings, and sometimes dental cleanings or spay/neuter procedures. By adding a wellness plan, you can spread the predictable costs of pet ownership out over monthly payments, making it easier to manage your budget and ensure your pet never misses their essential preventive care.

What Pet Insurance Typically Covers (A Deeper Look)

Beyond the broad categories of plans, it's helpful to look at the specific types of procedures and treatments that are generally covered by a comprehensive accident and illness policy. These are often the most expensive aspects of veterinary medicine.

- Emergency Care & Hospitalization: If your pet needs to visit an emergency vet clinic or be hospitalized overnight for monitoring and treatment, a comprehensive plan will typically cover these costs, which can quickly add up to thousands of dollars.

- Surgeries: This includes a wide range of surgical procedures, from emergency operations like foreign body removal or treating bloat (GDV) to necessary medical surgeries like tumor removal or orthopedic procedures.

- Diagnostic Tests: A major part of veterinary care involves figuring out what's wrong. Insurance covers crucial diagnostic tools like blood tests, X-rays, ultrasounds, MRIs, and CT scans that are necessary to get an accurate diagnosis.

- Prescription Medications: The cost of medications to treat covered conditions, such as antibiotics for an infection, insulin for diabetes, or pain relief for arthritis, is typically included in coverage.

- Chronic Conditions: This is a key benefit of pet insurance. Conditions that require long-term management, like allergies, arthritis, or diabetes, are usually covered as long as they were not pre-existing. This includes ongoing medication and follow-up vet visits.

- Hereditary and Congenital Conditions: Many comprehensive plans cover conditions that are passed down genetically or are present from birth, such as hip dysplasia in Labradors, heart defects, or certain eye conditions. However, coverage can vary, so it's vital to read the policy specifics.

- Cancer Treatments: Diagnosing and treating cancer in pets can be extremely expensive. Insurance can cover the costs of chemotherapy, radiation therapy, and surgery associated with cancer treatment, making life-saving care more accessible.

Understanding the Financials: How Pet Insurance Actually Works

Pet insurance doesn't work like human health insurance where a clinic bills the insurer directly. Instead, it operates on a reimbursement model. You pay your veterinarian for the services at the time of your visit, then you submit a claim to your insurance company. The insurer then reimburses you based on the terms of your policy. Three key financial components determine how much you get back:

- Deductible: This is the amount of money you must pay out-of-pocket for veterinary care before your insurance plan starts to reimburse you. Deductibles are typically annual, meaning you only have to meet them once per policy year. They can range from $100 to $1,000 or more.

- Reimbursement Level: This is the percentage of the vet bill that the insurance company will pay back to you after your deductible has been met. Common reimbursement levels are 70%, 80%, or 90%. A higher reimbursement level means you get more money back, but it also usually results in a higher monthly premium.

- Annual Limit: This is the maximum amount of money your insurance provider will reimburse you in a single policy year. Some plans have limits like $5,000 or $10,000, while others offer unlimited annual benefits, which provides the highest level of protection against catastrophic costs.

For example, imagine you have a plan with a $500 annual deductible, a 90% reimbursement level, and a $10,000 annual limit. If your dog has a $3,500 emergency surgery, you would first pay the $500 deductible. For the remaining $3,000, your insurance would reimburse you 90%, which is $2,700. Your total out-of-pocket cost would be $800 ($500 deductible + the remaining 10% of the bill).

Common Exclusions: What Does Pet Insurance *Not* Cover?

Just as important as knowing what is covered is understanding what is not. Every insurance policy has exclusions, and being aware of them can prevent surprises down the road. While they vary slightly by provider, some exclusions are nearly universal across the industry.

The most significant exclusion is for pre-existing conditions. This refers to any injury, illness, or condition that your pet showed signs of, was diagnosed with, or was treated for before your insurance policy's start date and waiting period ended. Insurance is designed for future, unforeseen problems, which is why no provider will cover issues that were already present. This is the primary reason experts recommend insuring pets while they are young and healthy.

Other common exclusions include routine and preventive care, unless you have purchased a specific wellness add-on plan. This means standard annual checkups, vaccinations, grooming, and flea and tick prevention are not covered by standard accident and illness policies. Additionally, cosmetic or elective procedures like tail docking, ear cropping, or declawing are not covered. Finally, costs associated with breeding, pregnancy, or whelping are typically excluded from coverage.

Is Pet Insurance Worth It for Older Pets?

This is a common question for owners of senior pets who are considering insurance for the first time. The decision involves weighing some clear pros and cons. The primary challenge is that premiums for older pets are significantly higher than for puppies or kittens, as their risk of developing health issues is much greater. Furthermore, any health problems your senior pet has already experienced will be classified as pre-existing conditions and will not be covered.

However, there is still a strong case to be made for insuring an older pet. While existing conditions won't be covered, a senior pet is still at risk for developing entirely new problems, such as a sudden cancer diagnosis, kidney disease, a broken bone from a fall, or an acute illness. These conditions can be incredibly expensive to treat, and an insurance policy can provide a crucial financial safety net. It offers peace of mind that if a new, major health issue arises, you will be in a position to afford the best possible care without depleting your savings or going into debt.

Making the Right Choice for Your Pet

In summary, pet insurance is designed to cover the costs of unexpected and often expensive veterinary care related to accidents and illnesses. From emergency surgeries to treatments for chronic conditions like cancer and diabetes, a comprehensive plan can make life-saving care affordable. Wellness add-ons can also help budget for routine care like vaccinations and checkups.

The key to making the most of a policy is to thoroughly understand its terms. Pay close attention to the deductible, reimbursement level, and annual limit, as these will directly impact your out-of-pocket costs. Most importantly, be aware of common exclusions, especially for pre-existing conditions. By reading the fine print and choosing a plan that fits your budget and your pet's potential needs, you can gain valuable peace of mind knowing you're prepared for whatever lies ahead.